best buy 401k rollover

Strong Retirement Benefits Help You Attract Retain Talent. This amount includes up to 20500 from the employee and 40500 from the employer.

Four Reasons To Rollover Your Old 401 K S Personal Finance Club

A 401k rollover typically happens when you leave your employer either to retire or to start a new job.

. Ad No Upfront Fees - No Risk. 1698 employees reported this benefit. For 2022 the maximum contribution amount to a 401k is 61000.

Consumer Electronics Television Radio Stores Major Appliances. It Is Easy To Get Started. Consumer Electronics Television Radio Stores Major Appliances 1 Website 201 556-1321.

If crowded GSP BB doesnt have it this one usually does. 1 the date you first contributed directly to the IRA 2 the date you rolled over a Roth 401 k or Roth 403 b to the Roth IRA or 3 the date you converted a traditional IRA to the Roth IRA. Top Gold IRA Rollover Companies of 2022 Augusta Precious Metals - Best gold IRA company.

Roll over the account into an. Compare the estimates and hire the contractor who best fits your needs. Ad Understand Your Options - See When And How To Rollover Your 401k.

Find an Attorney. Enter username and password to access your secure Voya Financial account for retirement insurance and investments. Search for legal issues.

A rollover from a 401k retirement plan to a gold IRA investment is non-taxable and doesnt attract penalties. This involves your 401 k provider wiring funds directly to your new IRA provider. YEARS IN BUSINESS 908 429-9339.

Get free estimates from financial consultants near you Get Estimates Invalid Zip code Find yours. The Right Way To Roll Over Your 401 K And Ira Money Marketwatch. Fast Professional Independent Expert Business Valuation 3 days.

Build Your Future With a Firm that has 85 Years of Retirement Experience. The bonus thresholds are. Transfer an account worth 10000001 to 250000.

Alternatively your 401. Leave your old 401 k account as is. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

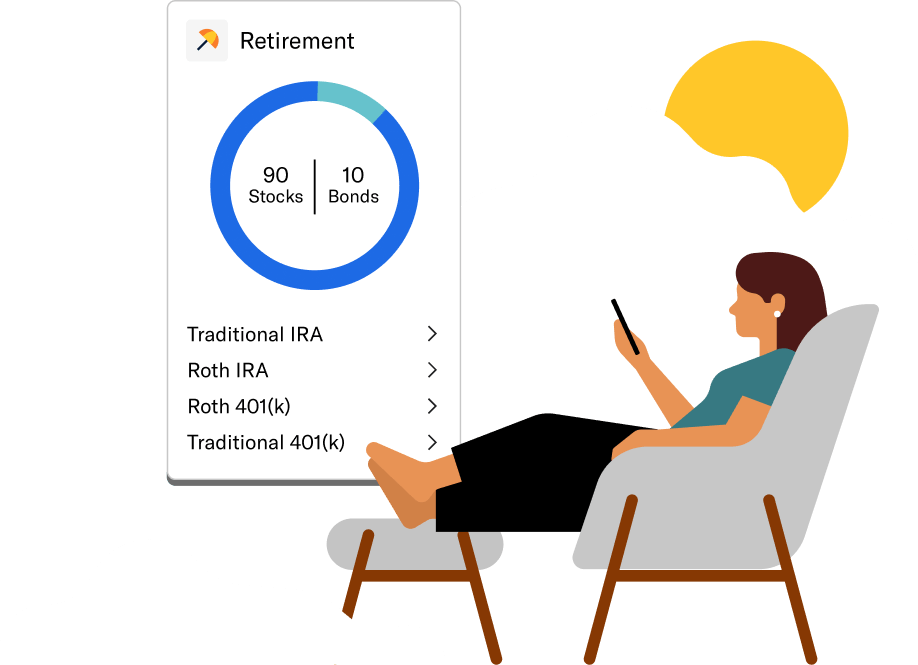

Mutual of America also offers Target-Date Retirement Funds through 2060. Financial Investment Strategies Asset Management Retirement 401k Rollovers in Edison NJ. There are four main possibilities when considering a potential 401 k rollover.

For 2022 the maximum contribution amount to a 401k is 61000. Great audiovisual and bluray selections can get latest when. And its rollover promotion for Money Crashers readers is nothing to sneeze at either.

Compare the best 401k lawyers near Piscataway NJ today. In-store pickup free shipping. Roll over an account worth 20000 to 100000.

Search Legal Resources. There is also a catch-up contribution of 6500 that applies to the employee side. Answer a few questions.

2400 Bergen Town Ctr. In this case your 401 provider withdraws your 401 balance and gives it to you in the form of a check. Available to US-based employees Change location.

An investor can also use existing retirement assets to fund a gold IRA like with the funds from a 401k to a gold rollover. Great selection and hours. Use our free directory to instantly connect with verified 401k attorneys.

Schwab Has 247 Professional Guidance. The 5-year holding period for Roth IRAs starts on the earlier of. Visit your local Best Buy at 300 Ridge Rd in Piscataway NJ for electronics computers appliances cell phones video games more new tech.

Heres what happens next. In many cases you can do a direct rollover also called a trustee-to-trustee transfer. An IRA may offer you more investment options and lower fees than your old 401.

See reviews photos directions phone numbers and more for 401k Rollover locations in Piscataway NJ. 1 the date you first contributed directly to the. Then as you might expect you have a 60-day window to get that money deposited in your new tax-deferred account.

If youre under age 59½ and you have one Roth IRA that holds proceeds from. Heres how to start and finish a 401 k to IRA rollover in three steps. A 401k rollover is the process by which you move the funds in your 401k to another retirement account usually either an IRA or another 401k.

There are a few requirements for the rollover process. 401k Contribution Limits. Best Buy 401K Plan.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. This amount includes up to 20500 from the employee and 40500 from the. Best Buy 401K Plan.

The second and less preferable option is the 60-day rollover. Transfer an account worth 25000001 to 500000. Choose which type of IRA account to open.

This 401k to gold IRA rollover guide ensures that your retirement funds grow tax-free with minimal risk.

Four Reasons To Rollover Your Old 401 K S Personal Finance Club

What Is A Rollover Ira Retirement Rollovers Explained Youtube

401 K Rollover To Ira 4 Simple Steps Guide Sbnri

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Gold Investment News Buying Gold And Investing Your Ira Or 401k Into Gold Is One Of The Best Ways To Have The Secu Gold Investments Buying Gold Ira Investment

How To Roll Over Your 401 K To A New Employer Gobankingrates

Rollover Revisited Why Sticking With A 401k May Be Better 401k Rollover Rollover Ira Individual Retirement Account

How To Roll Over Your 401 K And Why Ally

Should You Roll Over Your 401 K Youtube

401 K Rollover The Complete Guide 2022

Roll Over A 401k Or Ira Rollovers

401 K Rollover The Complete Guide 2022

10 Big 401k Plans Suspending Matching Contributions In 2020 401 K Specialist

401 K Rollover How To Roll Over A 401 K

Gold Ira Rollover Guide How To Execute 401 K Rollovers To Gold Paid Content Cleveland Cleveland Scene

The Complete 401k Rollover To Ira Guide Good Financial Cents

Capitalize Review Free 401 K To Ira Rollover Service Millennial Money With Katie